Recently, I spoke with someone who, at 50+, is establishing his credit rating for the first time. He’s excited to watch his rating improve as well as the possibilities that await. He’s eager to buy a home.

On the opposite side of the spectrum, my daughter will be turning 18 all too soon and working to build her credit for the first time. She has plans for her first apartment and buying a new car (without help from Mom and Dad). Doing some planning now will help set her up for success when the time comes.

Regardless of age or circumstance, understanding what a credit score is, as well as the impacts it can have, is essential to getting started and moving forward on the right foot. That way, as things progress, you can work to avoid missteps along the way.

Understanding credit scores

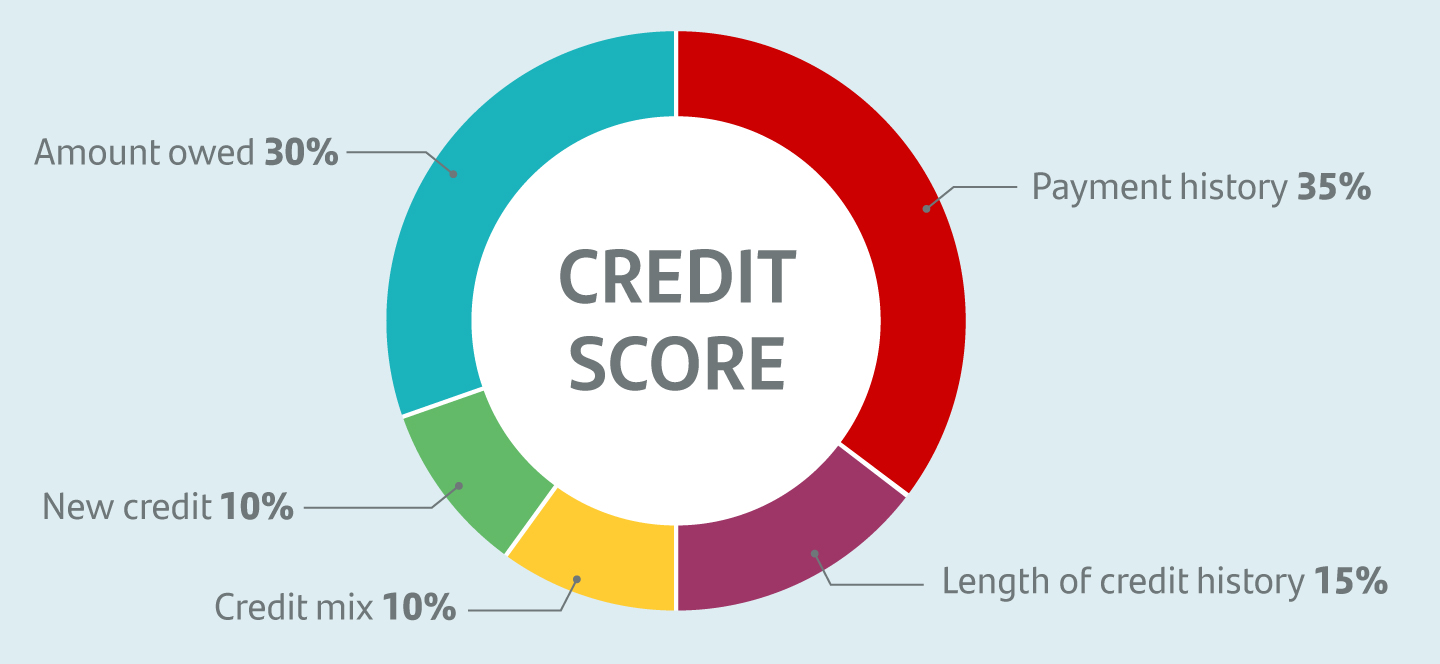

Paying bills on time is important, right? Did you know that, when it comes to your credit score, on-time payments carry the most weight in determining whether your score goes up or down? According to Forbes.com, it’s about 35 percent of your total credit score. Here’s how they break down the rest:

- Payment history (35%). Making payments on time is the most important thing you can do to establish and maintain a good credit rating.

- Amount owed (30%). Also known as credit utilization, this is the amount of credit you use compared to your available credit. In other words, if you have credit cards, don’t max them out. You want to try to keep the balance at, or below, 30 percent of your limit.

- Length of credit history (15%). This looks at the average age of your accounts and can positively impact your score over time.

- New credit (10%). Hard credit checks can reduce your credit score by as much as five points. Applying for a lot of accounts at once, in an effort to build credit, may actually hurt your score.

- Credit mix (10%). There are several different types of credit and, while having a mix of them isn’t required, it can improve your score.

Why establishing credit is important

These days, your credit gets pulled for a lot of things. For example, if you’re trying to rent an apartment or set up on a new phone plan, they will likely do a credit check. Some jobs may even run credit prior to employment.

By understanding what goes into your credit score, and then working to build your rating, you can benefit from things such as:

- Lower interest rates and more lending options

- Available rewards and deals on credit cards

- Lower insurance rates

- Lower security deposits (apartments, utility companies and more)

How can you start building your credit score?

Setting the foundation for a solid credit history is easier than it used to be. Tech companies, banks and financial institutions and even credit reporting agencies now have tools at your disposal to help.

Consider a credit card

Check into getting a secured credit card. They can be helpful for anyone trying to build first-time credit or repair damaged credit. After putting down an initial deposit to open the account, it works just like a regular credit card and helps to build your credit. Also, because the limit is typically low and based on the deposit, it helps a first-time credit card owner learn the ins and outs of responsible credit card use.

Another option is to become an authorized user on an established account. If you have a family member with good credit who is willing to add you as an authorized user, this may be an option to build your credit quickly.

There’s an app for that too

Technology has come a long way in helping to establish a first-time credit rating.

Mobile apps, like Experian Go™, have been created specifically to help build credit. If you choose to use one of the apps, you’ll want to do your research. Make sure the information they track and report is helpful to you. Also, make certain they report to at least one of the three major bureaus (Experian, Equifax and/or TransUnion) in a timely manner.

For accounts that are not currently reported (utilities, phone, etc.), tracking apps like Experian Boost™ can also help. If you have the accounts for which you’re paying the bill, you might as well get the credit for it, right?

And finally, if you’re paying rent but it’s not being reported to the credit bureaus, you can change that. When you sign up with companies like RentReporters and Rental Kharma, they will report your monthly rent payments to credit bureaus for you.

There are fees for some of these services, so that may be something to consider, depending on your budget.

Don’t rule out old reliable

Tried-and-true methods, of course, are still available as well. Credit-builder loans or obtaining a loan with a cosigner are other ways to start a solid credit foundation. They may take a bit longer to see results, but don’t forget that credit mix is a factor.

The long-term positive impact could be worth the wait.

Remember, it takes time

While we all appreciate faster ways to meet our goals, when it comes to credit scores, it’s important to understand that it doesn’t happen overnight. It takes time and patience to expand your borrowing ability by building a credit history.

If all else fails, and you find your patience being tested, remember these three rules of thumb:

- Pay your bills on time – it’s the most important thing.

- Check your credit reports annually. You get a free report from each of the three major bureaus (Experian, Equifax and TransUnion) once every 12 months. Pull all of them each year to check for errors and ensure everything is progressing as it should.

- It’s normal to have bumps along the way – it’s how you handle them that matters most.