As a whole, Americans seem to have become more aware of their spending over the last year. Before 2020, consumers added, on average, $45.6 billion in credit card debt each year.

But during 2020 and the beginning of 2021, consumers collectively paid off nearly twice that – a whopping $82.1 billion, according to a WalletHub study.

As the “return to normal” moves forward, spending is also expected to return to its pre-pandemic norm, as is the use of our ever-loved credit card.

Unfortunately, these days, that also means the chance of an increase in phishing, identity theft, fraud and more. There are a lot of online and phone scams and it can be a bit stressful, even overwhelming.

So, what do we do? How do we protect ourselves from this kind of activity?

Luckily, educating yourself about password protection, online security, etc., can help. Plus, credit monitoring and credit monitoring services can be useful tools.

What is credit monitoring?

Credit monitoring is, basically, keeping track of what is on your credit bureaus. By looking at (or simply knowing) your credit history, patterns can be found and unusual or suspicious actions can be spotted. New credit applications (also known as hard inquiries), new accounts, balances and payments, even name and address changes are all items that show up on your credit reports and can be watched.

What is a credit monitoring service?

Credit monitoring services, should you choose to use one, keep regular tabs on what’s going on with your credit bureaus and let you know about things outside the norm. A missed payment, for example, when you have a long-time history of on-time payments, could cause an alert. As could a new account or a change of address, signaling potential identity theft or fraud.

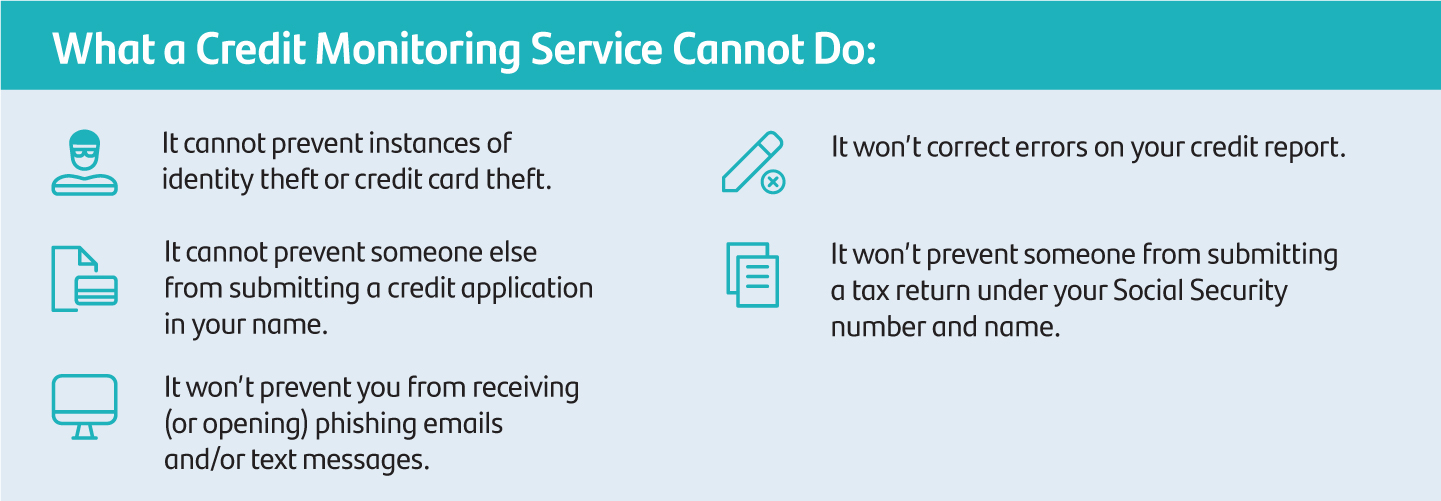

While such alerts can be very helpful, credit monitoring is not the end-all, be-all in credit protection. It’s important to understand what a credit monitoring service cannot do.

Keep in mind, credit monitoring services provide an added layer of protection by warning you about possible issues. They aren’t a replacement for shielding your private information or taking the necessary steps if something unfortunate does happen.

Do you need a credit monitoring service?

Only you know if a credit monitoring service is right for you. If you don’t feel you have the time, energy, resources or knowledge to do it yourself, then you may want to consider one of the many available credit monitoring services to provide you peace of mind.

There are several free options. Some credit card companies offer them to customers and non-customers, and Experian offers a free service as well. In addition, federal law allows for you to receive a free credit report from each of the three bureaus once every 12 months.

For additional services, you can choose a paid subscription. The cost of the paid subscriptions has a wide range, as do the services provided. Research is important. You’ll want to make sure the service you choose has what you need at a cost that is right for you.

Which credit monitoring service is best?

This is a hard question to answer because each credit monitoring service is different. Your needs likely vary from anyone else’s, so defining the “best” credit monitoring service really comes down to two things:

1. What do you need, or what expectations do you have, from the service?

2. How much can you afford, or are you willing to spend, on the service?

Once you know the answers to those questions, your search for a service that best suits your needs becomes smaller. And, something to keep in mind while doing your research is using a service that monitors all three bureaus. By monitoring all three, it’s less likely something will get missed because it appears on one bureau, but not the others.

If you are already skilled in this area and tend to keep a close eye on your credit score anyway, one of the free services that gives some added protection may be exactly what you’re looking for and worth looking into.

If you are already skilled in this area and tend to keep a close eye on your credit score anyway, one of the free services that gives some added protection may be exactly what you’re looking for and worth looking into.

Something else to keep in mind – through April 20, 2022, Experian, TransUnion and Equifax are offering all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help protect financial health during the sudden and unique hardships caused by COVID-19.

To learn more about improving your financial health, browse the resources across our Learning Center.